Many people who can see the need to protect persons injured by guns and can see the parallels for responsibility to motor vehicles have a problem with involving insurance companies. Writing recently in a diary about possible system for requiring insurance on guns, one of the most common concerns was a distrust or even hatred of insurers. This is understandable because insurance companies often deny claims or access to insurance; and denial is likely to be harmful and very upsetting to the person denied. In so many areas, insurance coverage is required in one way or another and is a barrier to people getting on with their lives. Nevertheless, insurance is necessary and it matters greatly how it is implemented.

So the question is how would the insurance experience for gun owners work out?

The system I am envisioning in my writing requires insurance to be purchased by manufacturers or importers in such a way that, to relieve an insurer of responsibility, each successive owner must take over or provide new insurance. If the gun is lost, stolen or diverted the responsibility stays with the current insurer. This is critical because the primary danger lawful owners make to the public is they may lose control of a gun. An important advantage of this system is that the government only has to regulate or even know about manufacturers, importers and insurers. There is no need to register privately owned guns for this to work.

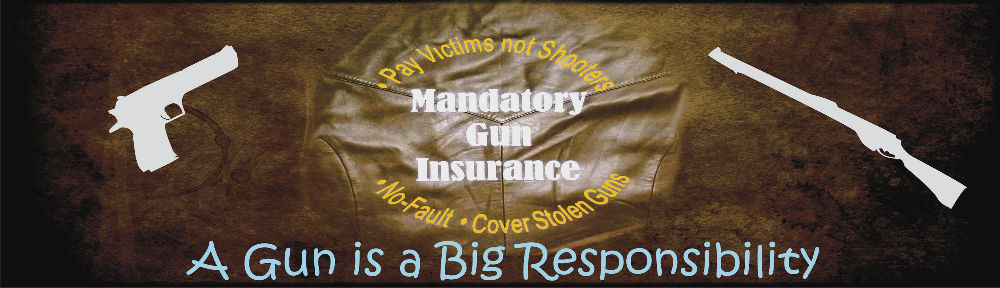

The legislation needed to mandate insurance would prescribe the types of incidents that would be covered and the requirements for payment. It is very important that it be a no-fault system for two reasons, the situation in many shootings is so unclear that, even if it’s obvious there must be some kind of fault, proving it can be very difficult and protecting the privacy of gun owners is very important. This gives insurers much less room is denying claims than in other kinds of insurance. No-fault insurance for automobiles works well in many states, but the comparison of cars to guns is to the Personal Injury Protection (PIP) coverage that’s part of many state systems as it applies to pedestrians, who often don’t have their own insurance. For examples, see Florida and New York.

For the purchasers of gun insurance, it’s likely that there would be substantial competition about rates. Gun selling businesses would work hard to make good and economical carriers available to their customers. Because the rates would probably vary significantly for customers in different situations, with different styles of storage and use and for different types of firearms, the insurers would be competing on convenience and privacy as well as price.

The big costs for automobile liability insurance claims are injuries and property damage rather than fatalities. Because guns are involved in only about 2.5% as many injuries as motor vehicles, the average cost would be low. Very generous benefits would have an average annual cost to insurers of less than $40 per gun. Limits similar to a less generous plan such as Florida’s PIP would be less than one quarter of that. These are averages; and particular situations would have higher or lower costs. In particular, guns that have been in the possession of owners for substantial periods have a much smaller chance of turning up in shootings later.