We need compulsory gun insurance for all guns that compensates anyone injured by shooting

Over 40,000 people a year are killed by guns. More than by cars or on the job, but these activities have insurance now. Current voluntary insurance just protects gun owners and pays for lawyers to block victim lawsuits. We need good insurance that pays to victims, avoids the need for lawsuits, and covers all guns. This will encourage a culture of safety for society as a whole and for each gun owner. Insurers will demand good practices.

Vehicle owners and employers are now required to have insurance, it has not stopped the development of these activities, but it has greatly mitigated the inherent risks. We need to do this for guns now.

Youtube Posting

Script

Need For Required Gun Insurance

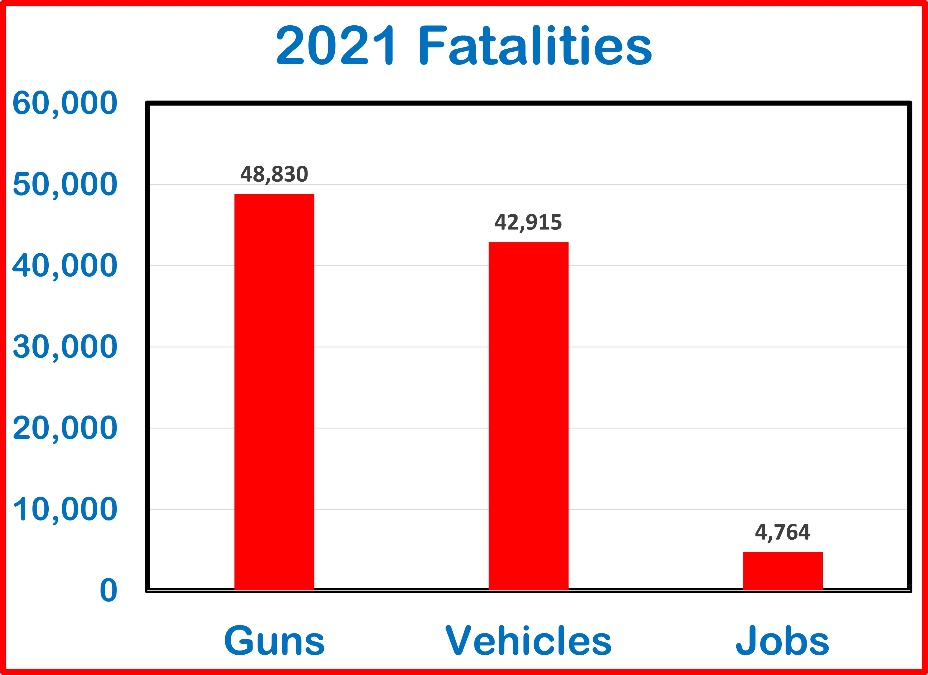

Guns are used to kill over forty thousand people in the United States each year.

That’s about the same number as are killed in car accidents and much less than the number of work-related deaths.

It’s clear that we have a pressing need [1] to reduce the gun carnage that happens every day.

According to Pew Research four-fifths of murders and half of suicides involve a gun.

There are many activities which we have in our society which have accompanying risks.

Practices and rules develop to mitigate the risks. [2] One of the most important practices is the use of insurance to help people who are hurt and to promote safety.

For important activities, such as driving and working, there are requirements to have insurance. Insurance that compensates those who are killed or injured.

We put a lot of effort in many ways to prevent injuries and deaths around vehicles and employment. In other areas a legal requirement is unnecessary because lenders [3] and business partners make the requirement themselves. But, it’s not so for guns. We don’t currently use insurance that pays gun victims. We are missing one of the most effective possibilities.

Look at these death statistics. [4]

The number of gun related deaths has kept rising and now it is even greater than the number of traffic fatalities.

This is in spite of the fact that a lot more people use cars on any given day than use guns.

This is even though our society has evolved to require using a car[5] for most critical activities.

The number of work related deaths has always been much less than the number of gun deaths.

Where there IS gun insurance now, it’s bought by gun owners to protect themselves. Sometimes, it provides funds for medical care and such; but it’s designed for legal assistance [6] to the owner–making sure that a victim can’t effectively sue for damages.

This is not the kind of insurance we need.

What we need is insurance that pays directly to the persons shot, to their survivors and to medical providers.

Good insurance paying to the victims can give emergency rooms and doctors the certainty they must have for supplying the kind of care wounded persons need.

Not just the minimal care they may give persons when they DON’T expect to be paid. THEN, it can pay for continuing care.

Care which may be needed for years.

It can provide a replacement for lost wages when a person can’t work, and it can provide for survivors when the victim dies.

Insurance also works to provide safety and reduce the number of incidents.

Insurers will look to the causes of shootings and insist gun owners and society in general adopt safe practices.

Insurers will insist that guns be properly secured and locked up when not in use.

It’s hard to enforce safety with laws and regulations without intrusive inspections.

Insurers will figure out what’s necessary to stop losses.

If their responsibility continues as it should, they will stop covered persons from leaving guns in unlocked cars.

Current gun training is strong on self-defense and accurate shooting; but that comes at the expense of training for safety.

Insurers will insist on proper training. they will create a culture of responsibility around guns.

There is an extensive record [7]of insurance companies, working in their own interest, developing safer practices in many ways.

Equipment, training, regulation, and even after the incident care get better.

Unsafe or unlawful people will be denied insurance.[8]

The costs will track the dangers and be reasonable for safe guns and safe gun owners.

The cost will be much lower than for vehicles, because insurers will not need to pay for smashed cars and will face fewer hard to define chronic injuries.

But still, owners who have guns that they no longer want will have an incentive to get rid of these guns rather than to keep up insurance.

Those guns now remain in the back of closets or in drawers and provide a substantial danger of being misused or getting in the wrong hands.[9]

Insurance has increased the level of safety in almost every activity where a risk is inherent.

It serves to facilitate the activities by controlling the risks and it does it in a way that reduces these risks. We require insurance for many activities and it works to help the grow.

Cars, jobs and commercial activities from construction to vaccine production couldn’t function in a modern society with out controlling risk with insurance.[10]

The terms and coverage of every kind of insurance are adapted to the needs of the activity that it covers.

This is a process that has happened many times.

Every aspect of what we need has been tried in one kind of insurance or another.

Every reason that blocks adopting the insurance—including the politics of the matter—has been faced before and ways to reach the goal have been discovered and implemented.

The videos in this series will explore these possibilities and the rich history of insurance adoption. It’s an amazing story.

References

Data

Workplace Fatalities

2017 5,147 fatal work injuries recorded in the United States in 2017

Bureau of Labor Statistichttps://www.bls.gov/news.release/cfoi.nr0.htms Economic News Release 12/18/2018

https://www.pewresearch.org/fact-tank/2022/02/03/what-the-data-says-about-gun-deaths-in-the-u-s/

45,222 deaths in 2020 according to the CDC Suicides 24,292 Murders 19,384, Accident 535, Law Enforcement 611

Line 15 CHART 001-01A Guns, Cars, Jobs

- 40,000 a year! ↑

- Not just legal requirements ↑

- Ho e. g. Home loans require homeowner’s insurance. ↑

- Insert table of gun deaths ↑

- Insurers fund a lot of car safety ↑

- Also to pay for stolen guns ↑

- Insurance Institute for Highway Safety (IIHS)

National Safety Council (NSC)

National Insurance Crime Bureau

Workers Compensation Research institute ↑

- Faster and more flexible than regulation. ↑

- e. g. Kids, Suicide, Theft ↑

- Also data collection, lending and medical services. ↑