An OP-ED in the New York Times on Jan 1, 2013 by David Newman titled “At the E.R., Bearing Witness to Gun Violence” does not mention insurance but shows the wide variety of cases which arrive. The author linking to an article in the New England Journal of Medicine states that household members are 18 times more likely than intruders to be the victim. NRA insurance excludes members of the gun owners family from coverage even if the gun owner is sued by them. The author also states a quarter of gun crimes in American E.R.’s were committed with guns wrested from armed guards citing an article in The Annals of Emergency Medicine. Assuming the shooter is indigent and uninsured (a good bet) the victim would have to sue the hospital who’s insurance company has deep pockets for defending the lawsuit. Perhaps there will be some free immediate treatment in such cases; but how about follow up. Fortunately, the article states that “Case fatality inside the hospital was much lower in the ED setting (19%) than other sites.” Low fatality makes insurance more important because of the need to take care of the injured both immediately and over time.

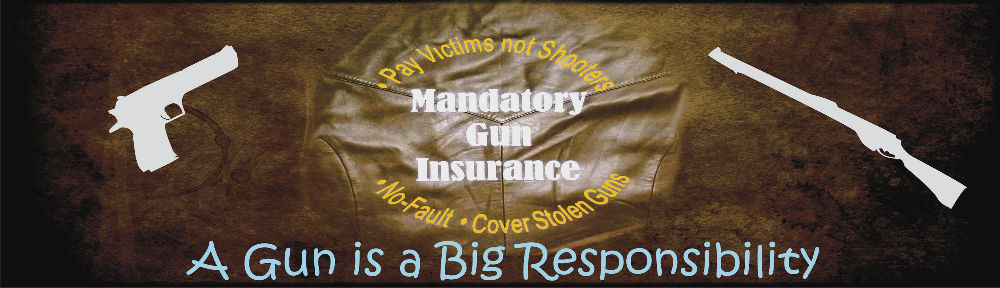

This blog is dedicated to advocating for developing an insurance plan which covers all situations and all shooters, at fault or not, legal or not, known or unknown. Other posts will analyze what is necessary to reach that goal.