The agent Lockton and the underwriter Chubb have announced that they would cut dies with the NRA. This may effectively end their Carry Guard insurance program, which is the insurance dubbed “murder insurance” by gun safety advocates. This has happened less than two weeks after the tragic shooting in Parkland, Florida and illustrates the rate that changes can occur in a charged are such as gun safety. Organizations Guns Down with Travon Martin’s mother Sybrina Fulton and Color of Change worked to bring this about. When the time was ripe their efforts took effect. Unfortunately, other organizations are currently selling insurance and quasi-insurance products of this type which are designed to protect gun users for legal responsibility for mistaken or over-zealous shootings claimed to be in self-defense.

Category Archives: Existing Insurance

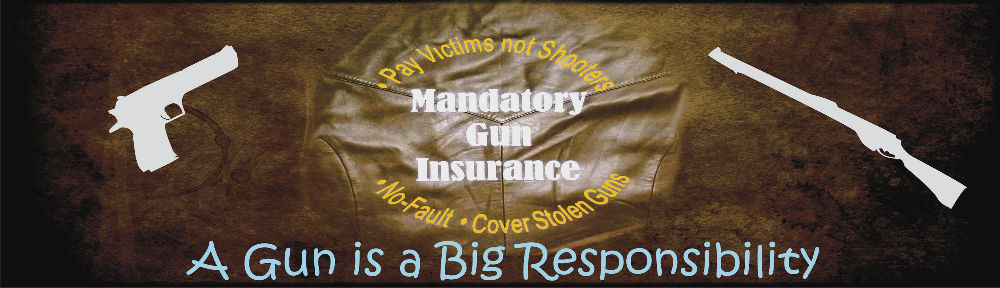

A Straightforward Recommendation for Gun Insurance

FIVE REASONS TO MANDATE GUN INSURANCE

To require additional individual responsibility such as locking up firearms

To provide victims with needed funds for medical and other costs

To make those causing the deaths and injuries pay, rather than the public through Medicaid or the victims through private health insurance

To supplement public regulatory oversight with private insurance company oversight

To encourage new technologies such as “safe guns” that would reduce accidents

(below the fold)

CAR INSURANCE AS AN ILLUSTRATION Continue reading

The Workers’ Compensation Bargain. A Model for Gun Insurance?

This is the second post in a series about workers’ compensation insurance as a model for mandating gun insurance. The series starts with Firearms and the History of Workers’ Compensation.

The two sides of the bargain

The Great Bargain of Workers’ Compensation is called that because employers gain immunity from lawsuits for negligence from their workers and the workers gain certainty that they will be compensated for work injuries by compulsory insurance purchased by the employers. As the first post in this series described; the system came out of an intense reform effort from many people determined to protect and benefit workers; but employers, especially the larger firms, also pressed hard for enactment of the system. The result was adoption of compulsory insurance in many states before 1920. Even in states where an employer could elect not to participate (still allowed in Texas) nearly all employers opted in to get protection from liability.

Cars v. Guns about Mandatory Insurance

Many people, when asked about the possibility of requiring insurance that would protect victims of gun violence, compare guns to automobiles; and, knowing that we require drivers to have insurance, think that it’s a reasonable thing to do with guns. It is a reasonable thing; but there are both similarities and differences.

Gun proponents, who often view compulsory insurance as simply an interference with rights they consider to be absolute, tend to offer a number of relatively unimportant differences by asserting things such as “car insurance isn’t required on private property or unless the car is being driven.” This isn’t always true; but, more importantly, it has little to do with how to handle a reasonable requirement for gun insurance.

The big difference is the way that we treat responsibility about the two classes of possessions and the politics of that responsibility. People are used to car owners being responsible for their cars and expressing that responsibility through liability and insurance. Gun proponents have worked to deflect responsibility away from owners and suppliers of guns and onto gun users; and then from gun users onto victims who can be perceived as responsible for their own injuries when the gun user thinks, rightly or wrongly, that shooting is justified.

The purpose of this post is to point out the similarities and differences that have substantial consequences in the design of appropriate insurance.

Similarities between Cars and Guns

Is Self-Defense Insurance Legal in California?

The National Rifle Association (NRA) and several other companies or organizations sell or sponsor the sale of insurance to defend and indemnify gun owners from liability in self defense situations. They do this on a nationwide basis and promise protection in a wide range of situations where the purpose of the gun use is to defend ones person or property. The point of this insurance is to have no restriction against covering self-defense as an intentional or willful act. The question raised in this post is: How can this be possible under California’s Insurance Code?

Mandatory Insurance for Armed Professions is Normal

We see armed people working around us on a daily basis. Some of these private professionals are highly visible such as guards for banks and armored car services and some are less obvious to the eye such as private investigators or detectives. In almost all states there are requirements for them to have licenses and in most states they must have insurance or bonds that function as insurance. But there is tremendous variation in the requirements and in the definitions and terminology of the various roles.

Questions and Answers on Mandating Gun Insurance.

Featured

Updated 12/22/2022

This post is a good place to start if you’re new to this blog. Scan the questions and follow the ‘Related:’ link(s) if you have an interest in a particular area.

Q: What is the purpose of mandating gun insurance?

Required insurance for guns or gun owners should be designed to provide benefits for victims of gun accidents or violence. Insurers will automatically take appropriate steps to encourage gun safety as part of their loss control and underwriting activities.

Related: Insurance-Good for Victims, Safety and Gun Owners

Q: What specifically would be the best insurance system for guns?

Each state should adopt a system of no-fault insurance with a system of delivering medical and cash benefits directly to victims. This insurance should be required to be in place for any firearm brought into or kept in the state in order for that firearm to be legal. It should provide all of the benefits available to victims of motor vehicle or workplace injuries.

Gun Insurance for Willful, Intentional & Criminal Acts.

One of the things that opponents of gun insurance or insurance trade representatives often say is that insurance cannot cover intentional or criminal acts. This is simply false.

There are many kinds of insurance that cover such acts. The key is that the insurance pays to the victim and not the wrongdoer. It doesn’t have to matter if the deed is done by the purchaser of the insurance or another insured person. It is important the the policy be written to make this clear; policies that exist at least partially for the benefit of third parties typically work that way. Insurance that is compelled by law for an activity often applies in these cases even if it’s not spelled out in the policy, but courts differ on this point and an explicit requirement in the legislation and in policy language is a good idea.

Insurance textbooks teach that whether an act is accidental or willful is determined from the viewpoint of the insured. Mandatory insurance should treat a victim as an also insured party. This is necessary because the purpose of many kinds of insurance is to protect the insured against the willful acts of outsiders. An example would be a day care center that is negligent in screening visitors who might commit an abuse against a child. From that viewpoint, a act that is deliberate on the part of the abuser is an accident to the victim.

Self-Defense Gun Insurance

Persons who carry guns for self defense or who keep guns in their homes often worry about the liability should they shoot someone. This motivates the drive by the NRA and other pro-gun organizations to adopt laws that immunize shooters, but it is also makes a substantial market for legal protection. It’s likely that steady publicity given to dubious claims of millions of defensive uses of guns make many people think that such protection is needed. There have sprung up a number of organizations which attempt to fill this market with products which may contain an insurance component or, if not claimed to be insurance, are similar to it in most respects.

National Assn. of Mutual Insurance Co’s Against Gun Insurance.

In a opinion article on Property Casualty 360 titled “Major Misfire” Paul Tetrault, state and policy affairs counsel for NAMIC, denounced the move in seven states and Congress to require insurance on guns. He repeated the statements that insurance cannot cover intentional acts. This blog has several times published numerous examples of current insurance that does cover intentional and even criminal acts to the benefit of parties other than the person who does the acts. This was pointed out to NAMIC but their spokesperson emailed that the organization stands behind the article.