The agent Lockton and the underwriter Chubb have announced that they would cut dies with the NRA. This may effectively end their Carry Guard insurance program, which is the insurance dubbed “murder insurance” by gun safety advocates. This has happened less than two weeks after the tragic shooting in Parkland, Florida and illustrates the rate that changes can occur in a charged are such as gun safety. Organizations Guns Down with Travon Martin’s mother Sybrina Fulton and Color of Change worked to bring this about. When the time was ripe their efforts took effect. Unfortunately, other organizations are currently selling insurance and quasi-insurance products of this type which are designed to protect gun users for legal responsibility for mistaken or over-zealous shootings claimed to be in self-defense.

The demise of insurance to protect shooters is welcomed by this blog and is a step forward in the effort to create a mandate for the kind of gun insurance that will protect victims of gun violence. This so-called self-defense insurance would almost never provide any benefits to the persons being shot. Insurers only have a duty to protect the parties they have contracted with from legal liability. There is a large incentive to stonewall any claimants to prevent other claims. An injured party or the survivors of a person killed would face a legal challenge that would make any effort to recover damages uneconomical even in egregious cases. The existence of this insurance even temporarily does show the possibility of insurers covering gun violence. This is useful information.

Unfortunately, as of the date of this writing March 1, 2018 Carry Guard is still being sold. A call to their phone number 1-866-672-5050 confirmed that the insurance was still available. If and when it will be withdrawn and new partners for the NRA found is uncertain. There are also two other sources of “self-defence” (or murder) insurance who also reported that they were still selling insurance as of that date. They are USCCA and Second Call Defense. Further work is needed.

The damage to the NRA and to the reputation of this kind of dangerous insurance from Chubb and Lockton’s withdrawal may be considerable. One of the barriers to adoption of good insurance that would protect victims is the confusion in many people’s minds with insurance design to protect shooters.

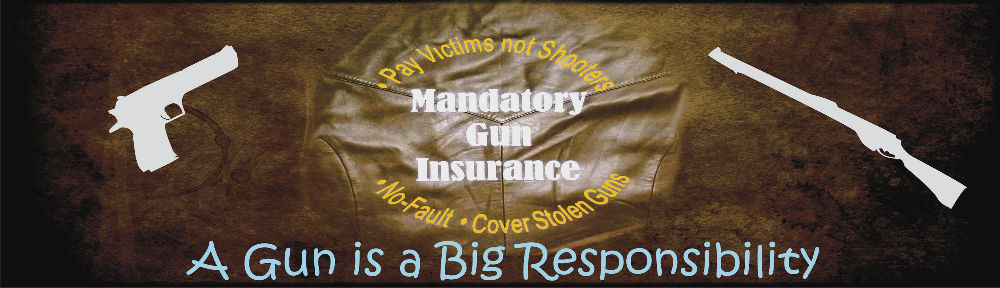

Real gun insurance designed to protect victims rests on three principles that are completely absent from “murder insurance.”

- The insurance should pay victims directly rather that defend shooters. This is what allows insurance that covers intentional and criminal shootings.

- The insurance should pay on the basis of the weapon causing the injury and the nature of the injury or loss and not because of fault or lack of fault by anyone.

- The insurance should be for identified guns and stay in effect if the gun changes hands without another insurer taking over responsibility. That is, it should cover lost, stolen or improperly transferred guns.

Insurance designed on these principles would not only compensate victims, but costs would very with the level of risk and insurers would be motivated to have effective safety requirements. Such an insurance requirement would compensate victims, provide reliable payment for medical care and promote safe practices. It would be cheap for safe gunowners and expensive for high risk situations.