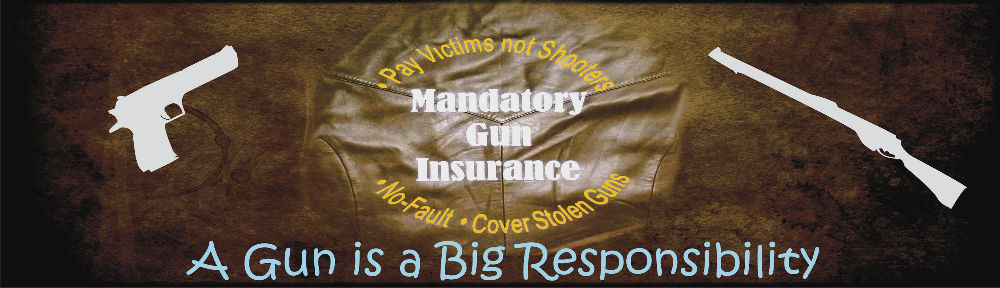

Insurance to protect persons from gun violence should make payments directly available to the victims or to doctors and hospitals who care for them. This would not only put the benefits where they are needed but would bypass most of the problems of providing coverage for intentional acts and stolen guns.

Liability Insurance

Liability insurance, on the other hand, is designed to protect gun owners and shooters. It pays for legal defense where the deep pockets of insurance companies create a barrier to victims ever being paid–even in egregious cases. insurers of cars, who collectively cover both sides of most cases, have over years worked out agreements between themselves to make liability insurance work. Not so for guns, where insurers would stonewall to the victims last cent.

While liability insurance for guns which is incidental to homeowner’s insurance or to business insurance may be beneficial, the liability insurance which is sold specifically for guns has been denounced by gun safety advocates as “murder insurance.” It has recently been outlawed in some states and has come under attack nationwide. Some of its problems come from it being voluntary insurance bought solely to protect gun owners and some of its problems stem from its focus on protecting shooters not victims. This is not a problem for insurance, especially compulsory insurance, that makes its payments to the people who are shot or their survivors.

Casualty Insurance

The advantages of requiring casualty insurance paying gun victims directly include:

- The insurance could pay for intentional or criminal actions even by the insurance buyer.

- It could pay benefits without regard to fault by anyone.

- The insurance could pay on the basis of the covered weapon even after the weapon changed hands legally or illegally—borrowed, stolen, picked up by a kid, illegally sold, etc.

- Delay while the legal process worked out responsibility could be eliminated.

- It would not require determination of what happened, who did it, was it legal or other conditions but only what weapon was involved and what loss occurred.

All of these are normal in many kinds of insurance. There are good models in widely sold insurance in various fields. Clear examples of these include personal protection benefits in no-fault states for cars and workers compensation in most states. Here mandating insurance is not controversial. If one owns a car or hires employees, one expects to get the necessary insurance.

The bottom line is that the key to an effective gun insurance mandate is to require insurance to pay its benefits directly to persons suffering loss.