The most important characteristic of the insurance needed for owning or carrying firearms is the basic structure of who is protected and paid by the insurance. Voluntary insurance is always designed to protect the insurance buyer or owner first and pays third party victims only when necessary to protect the policy holder. Required or mandatory insurance is intended to protect the public and persons other than the policy holder, and should promptly pay insured persons.

The usual kind of insurance that is discussed or included in legislative bills is liability insurance. Liability insurance obligates the insurer to defend the insured in court and pay in the insured party’s place if the injured person wins a lawsuit. It benefits victims in that it makes sure money to pay is available and it benefits the public because the insurer has a reason to pressured insured parties to reduce incidents and encourages safety. But it’s very difficult for an injured person to press a lawsuit against a well-funded insurance company. The company has a reason spend much more than is at stake in the current case in order to discourage other from suing and to prevent unwanted precedence.

This can be seen in the currently popular self-defense insurance pushed by the NRA and others. It’s designed to make it impossible for persons shot by their insureds to recover, whether intentionally or by accident. It’s so extreme, that victim’s advocates have taken to call it ‘murder insurance.’ Victims suing incident by incident can’t possibly match the resources of a major insurance company.

If liability insurance is a poor choice for structuring required gun insurance, why does it work in the case of automobiles? The answer is that most car accidents have insurers on both sides. If the liability insurance doesn’t pay, then the victim often has collision insurance that be responsible. The same companies sell both kinds of insurance. The insurance industry has worked out procedures over many years which allow settlement of claims without involving lawsuits or other expensive decision methods. Moreover, in cases of serious bodily injury, current automobile insurance often doesn’t actually work to protect victims unless they are able to prevail in complex litigation. This is a principle reason that no-fault car insurance is a better system for victims.

Insurance that protects victims must make payments to victims or to victim support agencies. Persons who have been shot need services and payment of expenses which can be medical, survivor support or even for funerals and burials. Insurance that pays victims directly, especially if mandated, can pay even in cases where the shooter is the insured party and is guilty of any degree of bad behavior. Concerns about a moral hazard and actions forbidden by public policy are greatly reduced or eliminated.

Gun victims are delivered to emergency rooms today with no assurance that the hospital rendering care will be paid for their efforts. They have an incentive to get the patient out of their doors quickly with the minimum of treatment and have no incentive to arrange follow-up. An insurer who is responsible for the future care of the victim, has an incentive to get adequate immediate care to limit future expenses. Immediate benefits are critical.

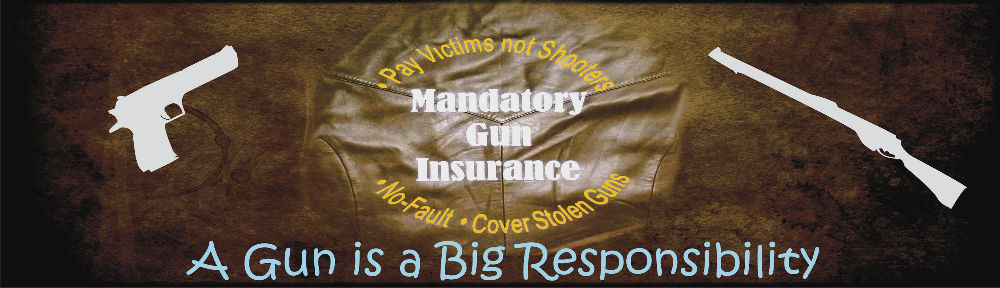

Other factors that could block or delay benefits should also be eliminated in the terms of the insurance. Benefits should not depend on who did the shooting, finding fault with the insured or the shooter, or finding no fault with the victim. All of these things are very hard to establish in many gun incidents and can bring the costs and delay of litigation into the settlement process. Insurance in other areas, such as worker’s compensation insurance or automotive personal injury protection handle this problem. No-fault automobile insurance usually has the injured person’s insurance pay first; but if there is not such insurance as in the case of cars hitting pedestrians, it provides a good model for what is needed for guns. Because guns stray from legal hands by many routes including loss, theft, illegal sale and being picked up by children, the insurance must stay in effect after these undesirable events take place.

Taking the factors above account, effective gun insurance for victims can be seen to require three basic elements in its terms:

- It must pay victims directly

- It must be in effect if the gun is used by someone other than the insured

- It must pay conditioned only on involvement of the covered gun and the injury.