It could have made a difference.

Because we don’t have a gun insurance requirement yet in this country, we don’t know what the rules would be. But insurers in other areas watch their losses and costs carefully and set their rates and willingness to insure on the basis of risks. There are a number of factors that would make insurers wary about issuing insurance to this shooter.

- The shooter was young only 21 years of age. Automobile insurers have special tighter rules and higher rates at least up to 25 years of age and often higher.

- The weapon was of an especially dangerous variety.

- The shooter had a record of instability that an insurer could have questioned or uncovered.

- Insurers would be likely to insist on additional delays and investigation. The shootings were less than a week after the gun purchase, so delay could have been important.

- Parts of Colorado had restrictions on assault weapons which were not overturned until after the purchase.

So, there is a good chance that a gun insurance requirement would have prevented this tragic incident.

There are other benefits

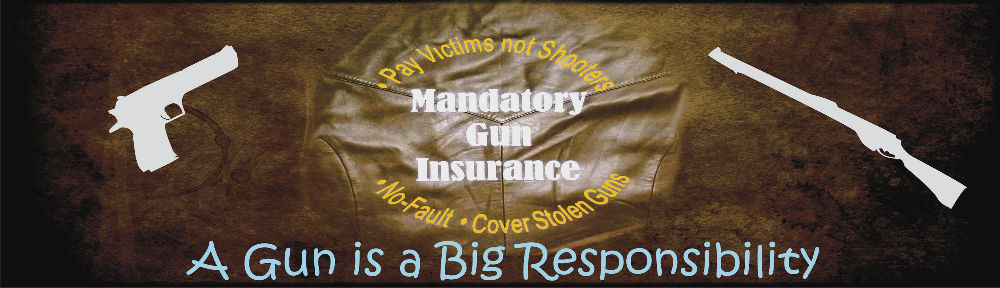

Good gun insurance pays victims directly. While money is a poor recompense for loss of loved ones, the survivors are likely to have serious needs in the future. Had there been more injuries payment for medical care could have been very important.

Insurance can reduce gun deaths and injuries indirectly

The current gun culture expects each individual gun owner to be responsible for safety and for not using weapons inappropriately. The results in some dangerous and irresponsible gun owners mixed into a very large number of others. Insurance is a symbol of responsibility and can change the overall view of society around guns. Insurers, if they remain responsible for stolen guns under the gun insurance requirement, can reduce substantially the number of guns that get into the most dangerous hands.