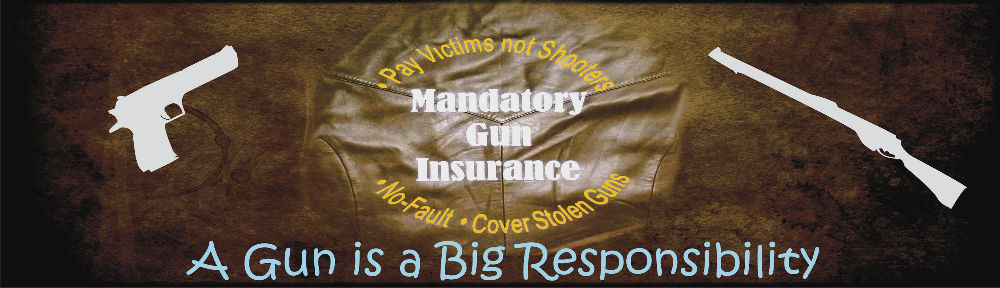

While it would be best to adopt gun insurance in the United States by national legislation that puts into place a full blown no-fault plan with the “Top-Down” provisions to guarantee that it covers all of the millions of guns in the country, it is not necessary to wait until that is politically feasible to make progress in protecting victims. There are several paths where an important part of this protection can be implemented both for it’s own value and to demonstrate the practicality of more complete plans.

The first and the one that already in the public eye is to adopt compulsory liability insurance for gun owners who are registered in particular states. This is the plan that is being offered in state legislatures. It would apply to a fairly small subset of the injuries and killings because it has no way to be in effect for illegal guns. But, as the proportion of gun injuries from legally possessed guns is going up due to a downward trend of crime in general and a greatly increased spread of legal guns, it would have a substantial value. It may very will be accomplished in some places in the next few years. This is the type of adoption that is seen by most writers who suggest insurance in the mass media.